On January 26, Zijin announced that its listed subsidiary, Zijin Gold International, has offered to acquire all issued common shares of Allied Gold, a Canadian gold producer, for a total consideration of C$5.5 billion (approximately RMB 28 billion). This acquisition – the largest in Zijin’s history – will add three large-scale, open-pit gold mines in Africa and position the company to achieve its target of producing over 100 tonnes of gold ahead of schedule.

If completed, the deal would expand Zijin Gold International’s portfolio to 12 gold mines across 12 countries.

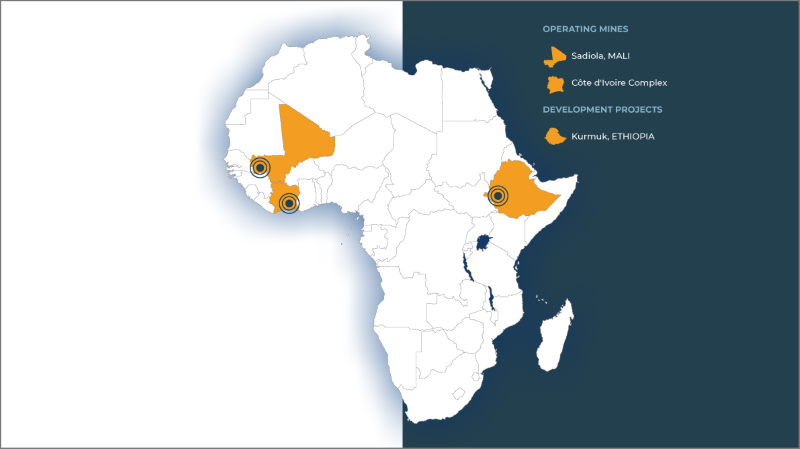

Three gold mines in Africa

As a company listed on the Toronto and New York stock exchanges, Allied Gold owns three key assets: the Sadiola Gold Mine in Mali, a gold complex consisting of the Bonikro and Agbaou operations in Côte d’Ivoire, and the Kurmuk Gold Mine in Ethiopia. Currently under construction, Kurmuk is scheduled for commissioning in the second half of 2026.

As of year-end 2024, Allied Gold reported 533 tonnes of gold resource holdings at an average grade of 1.48 g/t. Gold production totaled 10.7 tonnes in 2023 and 11.1 tonnes in 2024, with an estimated output of 11.7 to 12.4 tonnes in 2025. Once the Sadiola expansion and the Kurmuk project come online, total annual gold output is projected to reach 25 tonnes by 2029.

l Sadiola Gold Mine in Mali – Phase I expansion of the processing plant is largely complete, increasing throughput from 5 Mtpa to 5.7 Mtpa and raising annual production to 6.2–7.2 tonnes. Phase II is expected to lift average annual production to 12.4 tonnes over the first four years, with life-of-mine average output at 9.3 tonnes and all-in sustaining cost (AISC) reduced to US$1,200/oz.

l Côte d’Ivoire Complex (Bonikro and Agbaou) – Each gold operation currently processes around 2.5 Mtpa. Planned operational integration could lift average annual production to 3.1 tonnes at Bonikro and 2.7 tonnes at Agbaou.

l Kurmuk Gold Mine in Ethiopia – A major growth project designed with a throughput of 6.4 Mtpa, it is scheduled to commence production in the second half of 2026. Kurmuk is expected to produce 9 tonnes of gold annually on average during the first four years, and 7.5 tonnes over its mine life, with AISC below US$950/oz.

Unlocking value through operational optimization

Resource misallocation inevitably exists in the market; the key is to identify opportunities for value creation. Amid the ongoing gold bull market, the company has put a stronger focus on acquiring relatively mature mining assets or operational capacity. In recent years, it has bought multiple world-class, producing mines, including the Rosebel Gold Mine, the Akyem Gold Mine, and the Raygorodok Gold Mine. Leveraging in-house technological and managerial capabilities to enhance their performance, the company has achieved rapid growth in gold production.

In Zijin’s assessment, the three assets possess large resource bases, favorable mineralization conditions, and significant potential for further discoveries. They also benefit from mature metallurgical processes and robust infrastructure. Backed by Zijin’s in-house, end-to-end technologies and engineering capabilities, operational efficiency and capacity are expected to rise after the acquisition. Given these conditions, Zijin anticipates short payback periods and strong returns from these mines.

Furthermore, high gold prices create favorable conditions to unlock additional value through further exploration, resource re-assessment, and technical optimization, which may lead to reserve growth.

Expanding African gold portfolio

This acquisition will also reinforce Zijin’s gold footprint in Africa and forge synergies with existing assets on the continent. The Sadiola Mine in Mali and the Côte d’Ivoire Complex are close to Zijin’s Akyem Gold Mine in Ghana, forming a highly synergistic cluster along prolific gold belts in West Africa. Meanwhile, the Kurmuk project in Ethiopia is located near Zijin’s Bisha zinc-copper operation in Eritrea, offering considerable potential for collaboration in East Africa.

Zijin expects mined gold volume to increase by 23.5% year-on-year to 90 tonnes in 2025. The Allied Gold deal will provide a strong boost to the company’s gold segment and result in a surge in gold production. It is therefore a significant move in consolidating Zijin’s position among the world’s leading gold producers and advancing its goal of becoming a top-tier global mining company.

Since its listing in Hong Kong last year, Zijin Gold International saw continued growth in its market cap, ranking among the top five public gold companies globally. Upon completion of the transaction, its asset base, profitability, and global standing will be materially enhanced.

According to the announcement, the proposed transaction is subject to closing conditions, including approval by Allied Gold shareholders and regulatory clearances, filings or exemptions, and therefore, uncertainty remains until completion.

About Zijin Mining

Zijin Mining is a leading global metals and mining company and one of the world’s largest producers of gold, copper, and zinc. The company has more than 30 large-scale mining operations and projects across 19 countries on 5 continents. Leveraging strong in-house research, engineering, and development capabilities, Zijin maintains high operational efficiency and low costs in both acquisitions and operations. This enables the company to be an industry leader in value creation, underpinned by its philosophy of pursuing development for all and sustained by superior environmental, social, and governance performance. Zijin’s shares trade on the Hong Kong Stock Exchange (HKEX: 2899) and the Shanghai Stock Exchange (SSE: 601899).