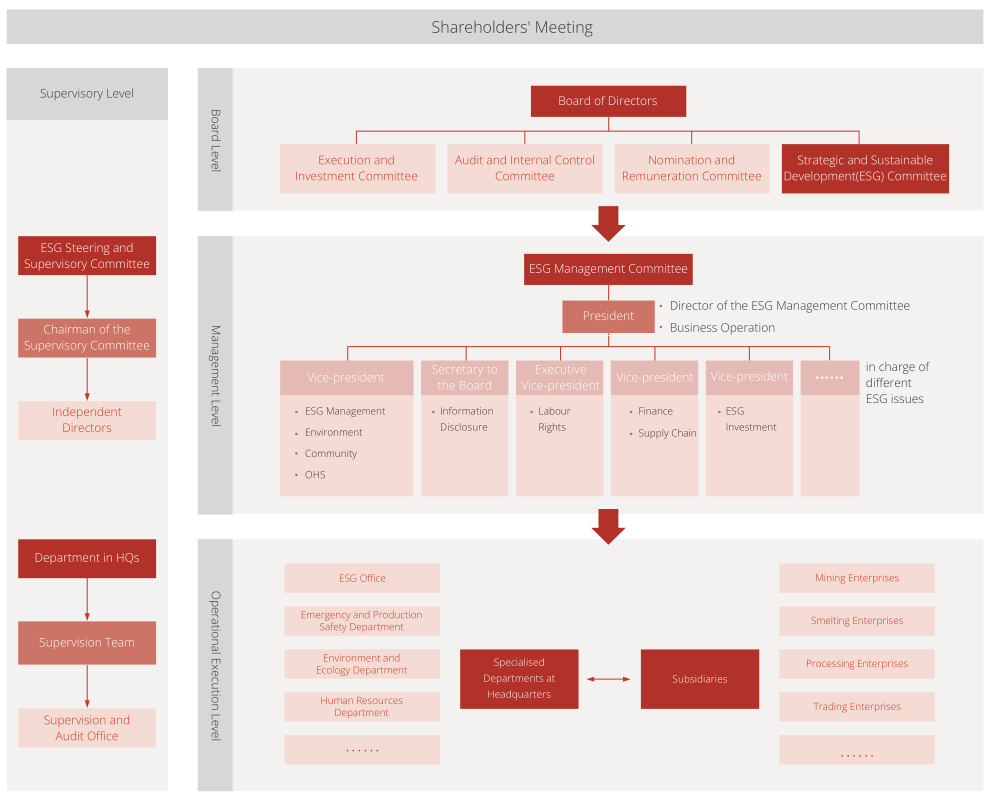

Under the Board’s guidance, the ESG Management Committee is responsible for driving and implementing the Company’s ESG strategy set by the Board, aiming to improve overall ESG performance. Chaired by the Company’s President, the Committee comprises heads of departments responsible for safety, environmental protection, business ethics, community relations, supply Chain, and labour development. With its high level of expertise and diversity, this multifaceted background enables a more comprehensive approach to addressing sustainability challenges.

Our senior executives responsible for sustainability also receive direct reports from departments managing ESG, safety, environmental protection, and community engagement, ensuring coordination in addressing key issues. Subsidiaries are tasked with carrying out ESG management responsibilities and implementing the Company's sustainable development strategies. Additionally, Cross-functional ESG Working groups, formed across headquarters and subsidiaries, further enhance the consistent execution of the sustainability strategy.

Through this comprehensive governance structure and ESG network, Zijin not only promotes effective ESG practices but also remains agile and adaptive in a dynamic global environment, effectively managing sustainability risks.