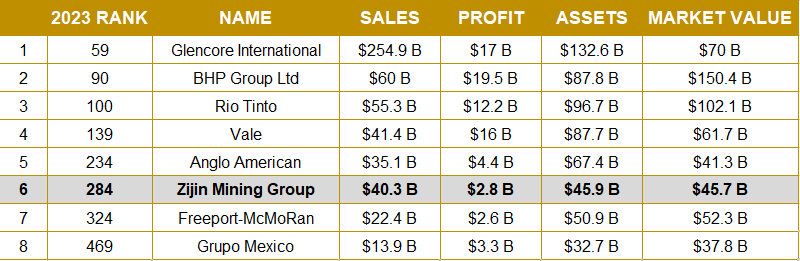

Metals and Mining Companies Rankings

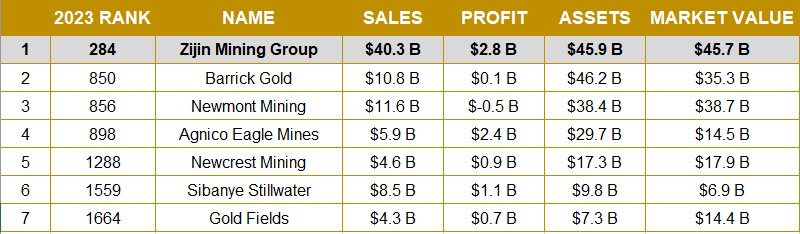

Gold Mining Companies Rankings

Zijin Mining has been ranked by Forbes as one of the top 300 companies in the world in its 2023 Global 2000 list, released on June 8. Zijin has soared to No. 284 in the ranking, marking an impressive rise of 41 spots compared to its position in 2022.

To generate the rankings, Forbes assigns equal weight to 12-month sales, assets, profit and market capitalization, using the most recent financial data available as of May 5, 2023.

Among the metals and mining companies included on the list, Zijin Mining ranks No.6, climbing one spot compared to the previous year. The top five slots are held by Glencore (No.59), BHP (No.90), Rio Tinto (No.100), Vale (No.139), and Anglo American (No.234). Glencore, in particular, ascended 32 places this year.

Among global gold miners, Zijin Mining continues to hold the No. 1 position on the list, followed by Barrick Gold(No.850) and Newmont (No.856).

In addition to Zijin Mining, seven other companies headquartered in Fujian are featured on the list, such as the Industrial Bank (No.60) and CATL (No.121). Among them, Zijin Mining and CATL experienced the most significant rise in rankings, suggesting that both companies are undergoing leapfrog growth.

In 2022, Zijin Mining delivered record financial results. It achieved a revenue of RMB 270.3 billion, an earnings of RMB 30 billion, and an attributable net profit of RMB 20 billion - an increase of more than 20% across all three indicators. Furthermore, it has become one of the world’s top 10 mining companies in terms of the resources and reserves of its main mineral products, key financial indicators, and market capitalization.

Translator: Vivian Jian Reviser: Lin Xindi Editor-in-Chief: Wang Jie

About Zijin Mining

Zijin Mining is a leading global metals and mining company and one of the world’s largest producers of gold, copper, and zinc. The company has more than 30 large-scale mining operations and projects across 19 countries on 5 continents. Leveraging strong in-house research, engineering, and development capabilities, Zijin maintains high operational efficiency and low costs in both acquisitions and operations. This enables the company to be an industry leader in value creation, underpinned by its philosophy of pursuing development for all and sustained by superior environmental, social, and governance performance. Zijin’s shares trade on the Hong Kong Stock Exchange (HKEX: 2899) and the Shanghai Stock Exchange (SSE: 601899).