Zijin News – On October 21, Zijin Mining entered into an agreement with Anhui Jinsha Molybdenum Co., Ltd. to acquire an 84% interest in the company for RMB 5.91 billion, which will see Zijin control the world’s largest molybdenum-only deposit.

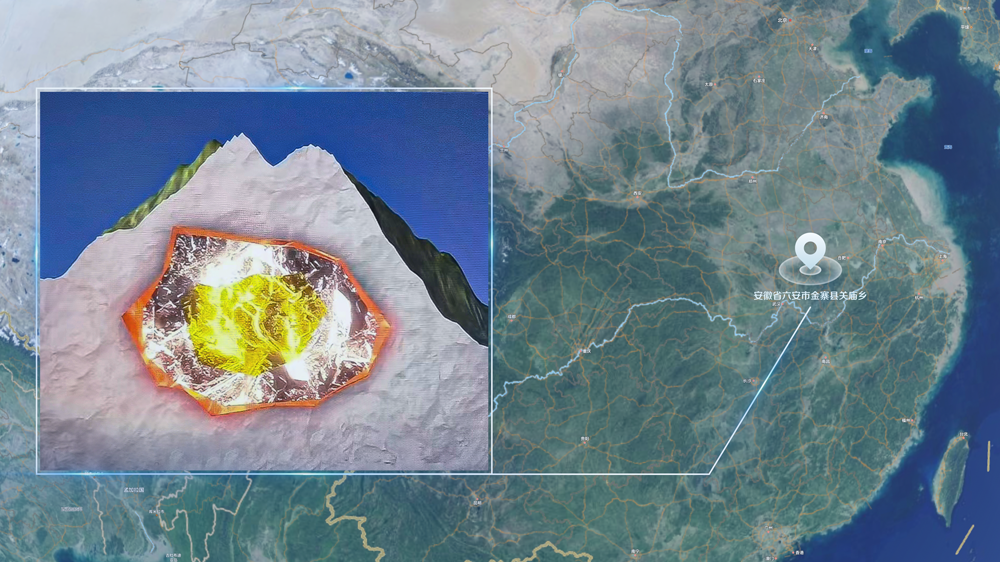

The deal was secured through public tendering at the Anhui Assets and Equity Exchange. Located in Jinzhai County, Anhui, China, the Shapinggou Molybdenum Mine is a world-class, ultra-large porphyry molybdenum deposit with 2,337,800 tonnes of resources within the area covered by the exploration license.

The project is designed to mill 10 million tonnes of ore and produce 27,200 tonnes of molybdenum per annum. Completion of the transaction is subject to the ongoing conversion of the exploration license into a mining license.

Following the completion of the acquisition, Zijin Mining’s attributable molybdenum resources will surge from 920,000 tonnes to 2.9 million tonnes, accounting for approximately one-third of China’s total. And the company will be on track to become one of the world’s largest molybdenum producers.

A high-grade deposit to create new scope for growth

The Shapinggou Molybdenum Mine is situated in Jinzhai County, an old revolutionary base deep in the Dabie Mountains. The deposit was discovered only at the beginning of this century.

It has 2,337,800 tonnes of resources and is the world’s largest molybdenum-only mine. With an average grade of 0.143%, the mine has about 630,000 tonnes of resources grading as high as over 0.3%, while 65% of molybdenum resources in China have a grade of less than 0.1%.

The deposit has only one main orebody that is 660 meters thick on average. The apple-shaped, thick orebody hosts 99.9% of the mine’s resources and is thus suitable for large-scale underground mining.

Such resource endowment will enable Shapinggou to achieve low-cost development and fast returns, making it a highly competitive project in the market.

According to the design of China ENFI Engineering Co., Ltd., the project will be built with a throughput of 10 million tonnes and produce 27,200 tonnes of molybdenum per annum after reaching its designed capacity.

Construction will be completed in 4.5 years and the project will have an initial mine life of 57 years.

Based on a price of RMB 150,000 per tonne of molybdenum concentrate, it is estimated the project will generate approximately RMB 1 billion in earnings per annum, creating brand new scope for Zijin’s growth.

Doubling down on a strategic mineral that represents the future

Molybdenum is a strategic, minor metal that is scarce in the world. There are few molybdenum-only deposits in the world as molybdenum often occurs as an associated mineral in copper and other metallic mines.

In recent years, there has been only a slow increase in the supply of the metal as it is subject to the development of copper mines.

China is one of the major molybdenum-rich countries in the world, and the largest producer and consumer of the metal. The country has a molybdenum resource of about 8.3 million tonnes and an annual production capacity of about 100,000 tonnes, accounting for 46% and 38% of the global total, respectively.

Molybdenum is in strong demand in both traditional industries and the renewable energy industry. Molybdenum and its alloys provide good thermal and electrical conductivity, high-temperature performance, and strong resistance to wear and corrosion.

They are widely used in such industries as steelmaking, chemicals, energy, and machinery manufacturing, with great potential for even more applications.

Against the backdrop of carbon emission reduction, the use of molybdenum is also growing rapidly in photovoltaic power, wind power, aerospace, arms production, etc.

The International Molybdenum Association predicts that by 2050, the wind power industry’s cumulative demand for molybdenum will reach 300,000 tonnes, topping the metal’s total annual supply. Some institutions even view molybdenum as the “mineral of the future”.

In recent years, Zijin Mining’s molybdenum resources have been growing rapidly. The company has copper-molybdenum mines such as the Julong Copper Mine in Tibet and the Duobaoshan Copper Mine, and its total associated molybdenum resources amount to approximately 920,000 tonnes.

By 2025, the annual production of associated molybdenum will be nearly 10,000 tonnes. Upon commissioning of the Shapinggou Molybdenum Mine, Zijin Mining’s molybdenum production capacity is expected to exceed 40,000 tonnes, making it the largest molybdenum producer in China.

According to data published by CRU, the global supply of molybdenum in 2021 was about 264,000 tonnes, while the demand was about 266,100 tonnes.

At present, there are only seven molybdenum mines in the world that produce more than 10,000 tonnes of the metal per annum, among which only two produce over 20,000 tonnes per annum. Upon commissioning, Shapinggou will likely become one of the largest molybdenum operations in the world, producing 10% of its total molybdenum supply.

Some S&P analysts believe that the global supply of molybdenum will remain tight over the next five years. The price of molybdenum concentrate recently rose to RMB 300,000 per tonne again after 14 years.

Translator: Chen Peng Reviser: Li Yuanxing Editor-in-Chief: Wang Jie

About Zijin Mining

Zijin Mining is a leading global metals and mining company and one of the world’s largest producers of gold, copper, and zinc. The company has more than 30 large-scale mining operations and projects across 19 countries on 5 continents. Leveraging strong in-house research, engineering, and development capabilities, Zijin maintains high operational efficiency and low costs in both acquisitions and operations. This enables the company to be an industry leader in value creation, underpinned by its philosophy of pursuing development for all and sustained by superior environmental, social, and governance performance. Zijin’s shares trade on the Hong Kong Stock Exchange (HKEX: 2899) and the Shanghai Stock Exchange (SSE: 601899).