On June 30, Zijin Mining announced that its subsidiary, Zijin Gold International and Jinha Mining (Zijin Gold International’s subsidiary in Singapore) have offered to acquire the Raygorodok Gold Mine (“RG Gold Mine”), a large producing asset in Kazakhstan, for a consideration of US$ 1.2 billion. This is Zijin Mining’s second gold deal in 2025 after it completed the acquisition of the Akyem Gold Mine in Ghana and its eighth major gold transaction since 2020, marking another key step in its global growth strategy.

The consideration of the proposed deal is based on a “cash-free and debt-free” valuation as of the reference date of September 30, 2025, with final adjustments to be made according to actual financials on that date.

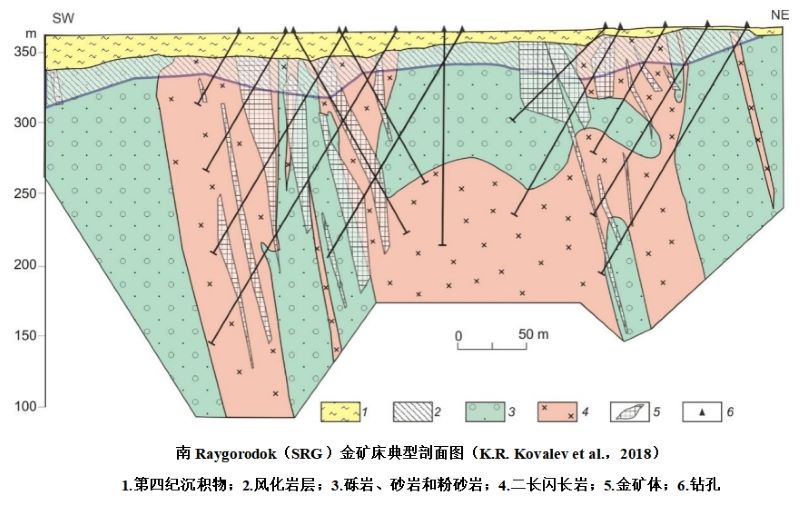

Situated in the Akmola Region of northern Kazakhstan, the RG Gold Mine consists of two open pits approximately two kilometers apart—the North and South pits. In terms of resources (gold price at US$ 2,000 per ounce), the mine has 241 million tonnes of ore (indicated and inferred) at an average gold grade of 1.01 grams per tonne, containing 242.1 tonnes of gold. Based on the existing designs (gold price at US$1,750 per ounce), ore reserves at the mine stand at 94.9 million tonnes, at 1.06 grams per tonne, containing 100.6 tonnes of gold.

The RG Gold Mine was put into production in 2016, with a heap leach system primarily processing oxidized ore. In 2022, a cyanidation plant was commissioned, employing the carbon-in-pulp (CIP) technique to process primary ore, with the end product being gold doré. The plant significantly boosted the mine’s production capacity and profitability. From 2022 to 2024, it produced 2, 5.9, and 6 tonnes of gold, respectively. In 2024, the operation generated US$473 million in revenue and US$202 million in net profit, demonstrating strong profitability. It is expected to contribute to Zijin’s gold production and earnings within the year of the acquisition.

Given current gold prices, Zijin believes that the RG Gold Mine has very strong potential for pit optimization to improve resource extraction within the open pits. Further expansions may also be advanced.

Zijin’s past acquisitions have shown that its core strengths lie not only in buying the right assets at the right time, but also in unlocking value soon after acquisition through its signature Five-Pronged Mining Engineering Model. This model allows the company to increase mineral resources at newly acquired mines, expand production capacity, and generate stable cash flow.

It is estimated that the RG Gold Mine has another 16 years of mine life (2025–2040), with an average annual gold production of approximately 5.5 tonnes. Preliminary studies by Zijin’s technical team suggest that, through pit optimization and improvement of mineral processing techniques, the project’s mining and processing capacity could rise to 10 million tonnes per annum, further boosting output and economic returns.

Doubling Down on Gold and Central Asia

Strategically, this acquisition represents a crucial milestone for Zijin, strengthening its global portfolio and intra-group synergy. It is also the company’s second gold acquisition this year following Akyem in Ghana, with each having an annual output of more than 5 tonnes, supporting Zijin’s push to produce 100 to 110 tonnes of mined gold by 2028.

As the world undergoes complex, profound changes, Zijin is reshaping its global footprint with strategic foresight—enhancing its presence in China and neighboring countries while bolstering its strategic gold portfolio.

Central Asia is a key hub for the Belt and Road Initiative and one of the world’s most resource-rich regions. The RG Gold Mine, together with the Jilau and Taror gold mines in Tajikistan and the Taldybulak Levoberezhny Gold Mine in Kyrgyzstan, forms Zijin’s “Gold Triangle” in Central Asia. These projects will also benefit from synergy with the company’s nearby mining, exploration, and logistics operations in China’s Xinjiang region.

Translator:Lin Xinjing Reviser: Jian Editor-in-Chief: Fa Yuan

About Zijin Mining

Zijin Mining is a leading global metals and mining company and one of the world’s largest producers of gold, copper, and zinc. The company has more than 30 large-scale mining operations and projects across 19 countries on 5 continents. Leveraging strong in-house research, engineering, and development capabilities, Zijin maintains high operational efficiency and low costs in both acquisitions and operations. This enables the company to be an industry leader in value creation, underpinned by its philosophy of pursuing development for all and sustained by superior environmental, social, and governance performance. Zijin’s shares trade on the Hong Kong Stock Exchange (HKEX: 2899) and the Shanghai Stock Exchange (SSE: 601899).