◎Highlight: The Company is the largest mined-gold producer in China. Gold business is an important contributor to the Company’s operating income and profit. In 2022, the Company’s gold business entered a fast growth lane, with a large number of gold projects successfully invested and acquired. As a result, the Company’s gold resources and production capacity have significantly increased. Among which, the newly acquired gold resources were approximately 682 tonnes, representing approximately 22% of the Company’s total gold resources. The construction of projects such as Shanxi Zijin, Guizhou Zijin, the Binduli Gold Mine of Norton in Australia, the Buriticá Gold Mine in Colombia and the pressurised oxidation project of Zeravshan in Tajikistan progressed in an orderly manner.

◎Resources: Gold resources were 3,117 tonnes, of which the proved and probable reserves were 1,191 tonnes.

◎Production: The Group produced 314,910kg (10,124,575 ounces) of gold, representing a decrease of 1.39% compared with the same period last year (same period last year: 319,348kg).

Among which, 56,360kg (1,812,021 ounces) was mined-gold, representing an increase of 18.76% compared with the same period last year (same period last year: 47,459kg);

258,550kg (8,312,554 ounces) of refined, processed and trading gold was produced, representing a decrease of 4.91% compared with the same period last year (same period last year: 271,890kg).

◎Costs: During the reporting period, the unit cost of sales of mine-produced gold was RMB191.77/gramme, representing an increase of 8.82% compared with the same period last year (same period last year: RMB176.22/gramme).

◎Contribution:Sales income from the gold business represented 38.41% (after elimination) of the operating income during the reporting period. Gross profit generated from gold products represented 24.55% of the gross profit of the Group. (1 troy ounce = 31.1035 grammes)

Major gold mines or enterprises |

Name |

Ownership |

Consolidated - Mined Gold (koz) |

Attributable - Mined Gold (koz) |

Buriticá Gold Mine, Colombia |

69.28% |

247 |

171 |

Zeravshan, Tajikistan |

70% |

208 |

145 |

Longnan Zijin |

84.22% |

178 |

150 |

Norton, Australia |

100% |

177 |

177 |

Serbia Zijin Mining |

100% |

152 |

152 |

Altynken, Kyrgyzstan |

60% |

123 |

74 |

Guizhou Zijin |

56% |

89 |

50 |

Aurora, Guyana |

100% |

88 |

88 |

Luoyang Kunyu |

70% |

87 |

61 |

Duobaoshan Copper Industry, Heilongjiang |

100% |

84 |

84 |

Serbia Zijin Copper |

63% |

82 |

52 |

Hunchun Zijin, Jilin |

6100% |

71 |

71 |

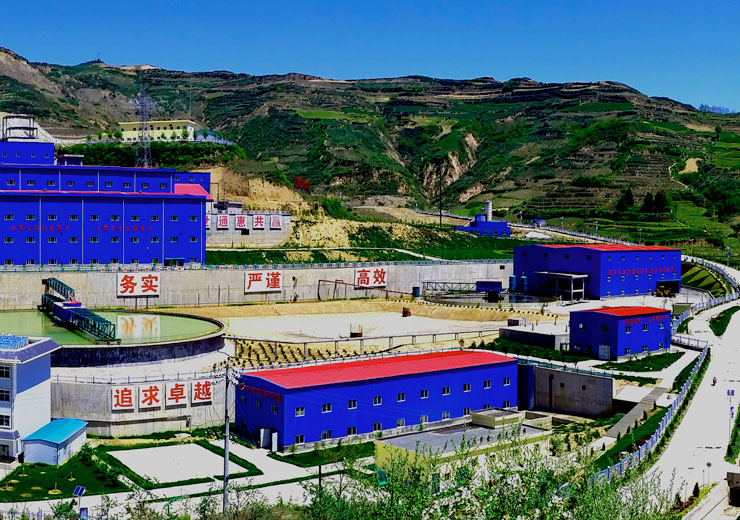

Shanxi Zijin |

100% |

66 |

66 |

| Other sites |

161 |

136 |

Total |

1812 |

1476 |

Major gold refineries |

Name |

Ownership |

Consolidated-Refined gold (Moz) |

Attributable-Refined gold (Moz) |

Zijin Gold Smelting |

100% |

5.03 |

5.03 |

Cross-Strait Gold Jewelry Industrial Park |

50.3% |

1.48 |

0.74 |

Ziiin Yinhui |

100% |

0.82 |

0.62 |

Total from other gold refineries |

0.98 |

0.98 |

Total |

8.31 |

7.38 |

Investment Product

Investment Product Reserve Assets

Reserve Assets Gold Jewelry

Gold Jewelry Components for Technology Products

Components for Technology Products