Zijin News – On the evening of October 18, 2022, Zijin Mining (“Zijin” or “the Company”) announced that it will acquire IAMGOLD’s (“IMG”) (TSX: IMG)(NYSE: IAG) 95% interest in Rosebel Gold Mines for cash consideration of USD 360 million (approximately RMB 2.56 billion). The acquisition of this world-class gold mine will give another strong boost to Zijin’s gold business.

As one of the largest producing gold mines in South America, the Rosebel Gold Mine has reported around 217 tonnes of gold resources. Since its commissioning in 2004, the project’s average annual gold production stands at over 10 tonnes, and the first half of 2022 saw a production of about 3.5 tonnes. According to preliminary estimates, the mine will produce more than 8.6 tonnes of mined gold per year, with the potential to further expand its production capacity.

Inflation has remained high over the past two years, and gold prices dropped further due to recent hikes in interest rates. The prices of gold assets are therefore relatively low. Gold has become popular as an investment instrument and a hedge against risks.

Earlier this week, Zijin announced it will acquire a 30% interest in the Haiyu Gold Mine - a flagship project of Zhaojin Mining Industry Co., Ltd. The successful closing of the two transactions will bring Zijin’s attributable gold resources to about 2,800 tonnes, bolster its gold output, and increase its competitiveness in the global gold mining industry.

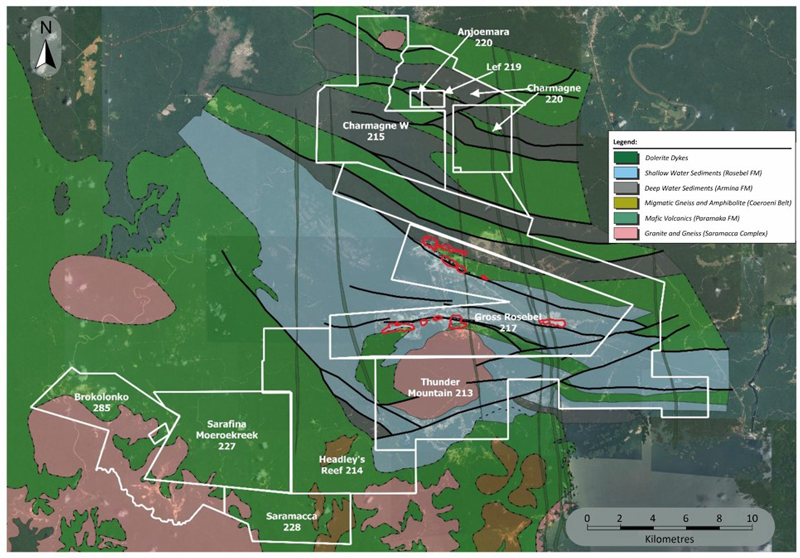

Geological map of the Rosebel mine

Over 200 tonnes of gold resources, with significant potential for additional resources

Situated in the tropical region of South America, the Republic of Suriname is a traditional mineral producer with abundant mineral resources that can be explored and mined throughout the year. The Rosebel gold operation is located in northern Suriname. According to the NI43-101 report prepared by two Canadian consulting companies, SRK Consulting (Canada) Inc. and WSP Canada Inc., the mine contains an enormous gold resource - approximately 217 tonnes of gold resources grading 1.11 g/t on average, of which 119 tonnes are reserves grading 1.09 g/t on average.

The project owns two major mining concessions- a 100% interest in the Rosebel Gold Mine and a 70% participating interest in the Saramacca Gold Mine, as well as nine exploration rights covering an area of around 788 square kilometers. Site survey and investigation indicate that the Rosebel property contains 7 deposits and several satellites, each having a strike length of around 1.2 to 3.3 kilometers and width of 100 to 900 meters. The mineralized trend remains open on strike and at depth, with great potential to add further gold resources.

The project has been advancing production and prospecting side by side. The current resources have exceeded the amount upon its commissioning with the LOM expected to be extended.

Concentrator of the Rosebel operation

Mature gold mine with production capacity expanding, with immediate contribution in incremental gold output

The Rosebel Gold Mine is an open-pit operation. The main Rosebel mine and the Saramacca mine were put into production in 2004 and the second half of 2020, respectively. The concentrator plant has a designed throughput of 12.5 Mtpa in the case of soft rock, or 7.7 Mtpa for hard rock. By the end of 2021, it had produced a cumulative total of approximately 176 tonnes of gold, averaging over 10 tonnes of gold per year and accounting for around 1/3 of Suriname’s total gold output.

Since 2019, the production of the project has come under significant pressure due to the COVID-19 pandemic, heavy rains in South America and insufficient stripping. As the operations improved in the first half of 2022, the project recorded an H1 gold production of 3.5 tonnes. According to the production schedule prepared by IMG, the proposed transferor, the gold production of the mine averages around 8.6 tonnes, over its 12-year mine life from 2022 to 2033, and 9.7 tonnes from 2024 to 2032.

As a mid-sized gold mining company listed in the Toronto Stock Exchange, IAMGOLD holds stakes in the Westwood gold mine in Canada, the Essakane gold mine (in production) in Burkina Faso, and the Côté gold mine that is currently under construction with significant capital expenditure.

IMG’s Chairman of the Board and interim CEO Maryse Bélanger said that the transaction with Zijin represents a significant step forward in pursuing IMG’s strategy of disciplined portfolio management. The deal would help IMG to create greater value for its shareholders through a focus on its core assets, as the proceeds of the sale will be invested in the construction of its flagship project, the Côté Gold Mine.

After site due diligence, the Zijin technical team noted that the Rosebel operation is fully equipped and expects no subs

tantial follow-up capital expenditure. After the acquisition, Zijin will further optimize the mining process and reduce mining and stripping costs by leveraging its technical and management expertise. Meanwhile, the ongoing equipment upgrading of the concentrator will be completed in the second half of 2023. The Saramacca mine was just commissioned and is fast-tracking its effort to reach steady-state performance. The recovery rate of the Saramacca mine increased to 92% by the end of Q2, 2022. The project has been troubled by problems like declining output and increasing operational costs in recent years. However, the project will see these problems resolved and a fast return on investment.

According to Zijin’s investment team, Zijin and IMG have entered into a definitive agreement on the evening of October 17, Toronto time. Under the agreement, Zijin will acquire 95% class A shares and 100% class B shares of Rosebel Gold Mine N.V. (“RGM”) via an overseas wholly-owned subsidiary. The remaining 5% interest in Rosebel will continue to be held by the Government of Suriname.

IMG welcomes Zijin’s offer to acquire. “Rosebel has been an important contributor to IAMGOLD and we are pleased that Zijin, a leading global mining company, will be taking over this operation for the benefit of all stakeholders. We will work closely with Zijin to ensure a smooth transition,” Maryse Bélanger further noted.

There remain uncertainties as the transaction is subject to certain regulatory approvals such as the approvals from the Chinese and Surinamese governments according to the agreement.

Translator: Shang Yutong Reviser: Fang Jie Editor-in-Chief: Wang Jie

About Zijin Mining

Zijin Mining is a leading global metals and mining company and one of the world’s largest producers of gold, copper, and zinc. The company has more than 30 large-scale mining operations and projects across 19 countries on 5 continents. Leveraging strong in-house research, engineering, and development capabilities, Zijin maintains high operational efficiency and low costs in both acquisitions and operations. This enables the company to be an industry leader in value creation, underpinned by its philosophy of pursuing development for all and sustained by superior environmental, social, and governance performance. Zijin’s shares trade on the Hong Kong Stock Exchange (HKEX: 2899) and the Shanghai Stock Exchange (SSE: 601899).