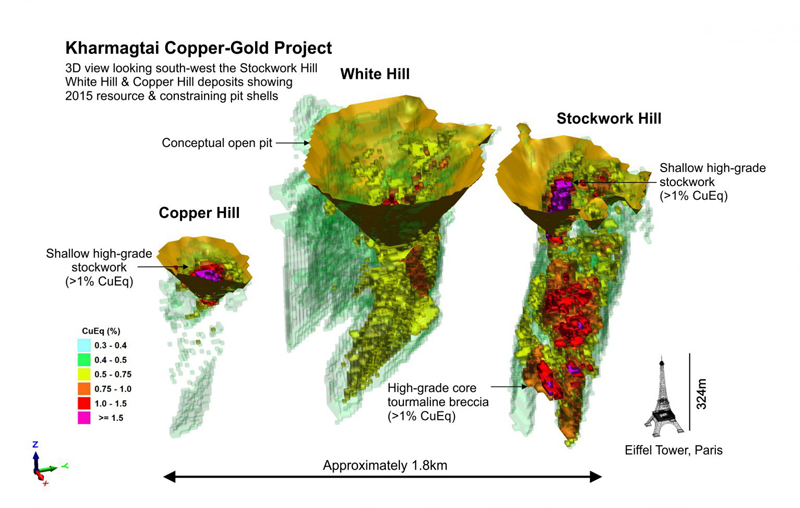

Three-dimensional mineral prospectivity model of Kharmagtai

Zijin News - On December 20, Zijin Mining Group Co., Ltd. (“Zijin”) and Xanadu Mines Ltd. (“Xanadu”) signed Phases 2 and 3 investment agreements for the acquisition of the Kharmagtai copper-gold project (“Kharmagtai”) in Mongolia. Zijin will hold a 45.9% interest in the Kharmagtai copper-gold project following the deal, making it the largest shareholder of the project.

Zijin previously acquired a 9.84% stake in Xanadu. The new deal will enable Zijin to take leadership of the development and operational phase for Kharmagtai, with an estimated investment of approximately US$43.8 million.

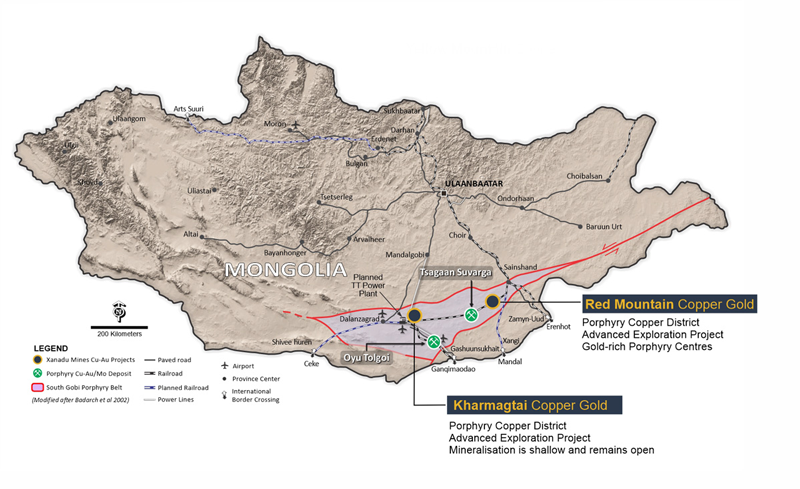

Situated within the South Gobi porphyry copper province

Kharmagtai is an advanced exploration project. The mine has a mineral resource estimate of 1.1 billion tonnes, containing about 2.93 million tonnes of copper, and 243 tonnes of gold. The scoping study for the Kharmagtai open-pit project has been completed and the pre-feasibility study (PFS) will commence in early 2023.

The PFS, including a mining and processing plan and a JORC or NI 43-101 compliant ore reserve report, will take 18 months to complete and take the project to a potential Final Investment Decision (FID) as early as 2024

Zijin will become the operator of Kharmagtai after delivery of the Kharmagtai PFS or 18 months from completion of the Phase 3 transaction.

Situated within the South Gobi porphyry copper province, the Kharmagtai mine is a large and thick deposit, with the main orebody remaining open along strike and at depth, giving it significant potential to add more reserves.

Zijin will continue to advance Kharmagtai’s exploration growth program, which will target high-grade mineralization at depth and new discoveries within the tenement.

Three-phased investment

Zijin and Xanadu signed a share subscription agreement in April 2022. According to the agreement, Zijin will make a three-phased acquisition.

Phase 1 Placement was completed on April 27. In Phase 1, Zijin acquired a 9.84% interest in Xanadu with A$5.56 million. Phase 2 and 3 investment agreements signed on December 20 are basically the same as those agreed in the subscription agreement.

Phase 2 Placement will involve Zijin subscribing for approximately 10% equity interest in Xanadu with the issue of 179,116,132 ordinary shares at A$0.04/share for a total investment of A$7.165 million. This will increase Zijin’s shareholding in Xanadu to 19.99%, and give it the right to appoint one Director to the Board of Xanadu Mines Ltd.

In Phase 3, Zijin will subscribe for 10 million newly issued shares of Khuiten Metals, a 100% owned subsidiary of Xanadu, by way of share placement for a cash payment of US$35 million. Once the subscription is completed, Zijin and Xanadu will each hold a 50% stake in Khuiten Metals, the entity that owns 76.5% of Kharmagtai.

Zijin has already received approval from the Australian Foreign Investment Review Board in respect of Phase 2 and 3 investments. The investments are still pending approval by regulators from the People’s Republic of China and shareholders of Xanadu Mines.

Translators: Wei Yalin, Lin Xindi Reviser: Li Yuanxing Editor-in-Chief: Wang Jie

About Zijin Mining

Zijin Mining is a leading global metals and mining company and one of the world’s largest producers of gold, copper, and zinc. The company has more than 30 large-scale mining operations and projects across 19 countries on 5 continents. Leveraging strong in-house research, engineering, and development capabilities, Zijin maintains high operational efficiency and low costs in both acquisitions and operations. This enables the company to be an industry leader in value creation, underpinned by its philosophy of pursuing development for all and sustained by superior environmental, social, and governance performance. Zijin’s shares trade on the Hong Kong Stock Exchange (HKEX: 2899) and the Shanghai Stock Exchange (SSE: 601899).