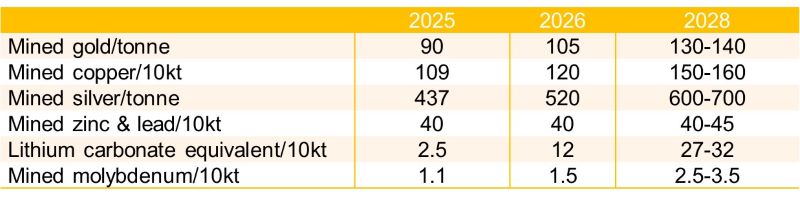

Commodity Production Guidance for 2026 and 2028

On February 9, Zijin announced its Three-Year (2026–2028) Guidance and 2035 Long-term Objectives, outlining a clear roadmap toward becoming a “green, high-tech, top global mining company”.

By 2028, the company aims to rank among the world’s top three miners by copper and gold production, while also placing itself higher in the industry in terms of resource holdings, commodity output, revenue, asset size, and profit. It also wants to establish well-suited, Zijin-specific frameworks for both global operations management and ESG within the same timeframe. By 2035, the company plans to leapfrog its 2025 performance levels, with some indicators reaching the highest among global peers, thus becoming a top global miner.

Production growth will remain robust, according to Zijin’s new plan. By 2028, its volumes of mined metals are projected to reach:

- Gold: 130–140 tonnes (up 44–56% from 2025)

- Copper: 1.5–1.6 million tonnes (up 38–47%)

- Silver: 600–700 tonnes (up 37–60%)

- Lithium carbonate equivalent: 270,000–320,000 tonnes (up 980–1,180%)

- Molybdenum: 25,000–35,000 tonnes (up 127–218%)

Chairman Zou Laichang said: “While we have a long journey ahead to achieve our goal of becoming a ‘green, high-tech, top global mining company’ by 2035, Zijin’s history is defined by making the impossible possible through perseverance and dedication. By staying true to Zijin’s corporate spirit and culture, we will forge ahead steadily, making consistent progress toward our strategic goals.”

Announced under Zijin’s new Board of Directors and executive team, this new vision represents ambitious targets beyond its already accomplished goal of joining the ranks of the world’s leading miners. The vision aligns with the company’s recent moves—including the proposed acquisition of three large gold mines in Africa from Canada’s Allied Gold and its US$1.5 billion H-share convertible bond issue at zero coupon. They signal the leadership team’s push for a new phase of expansion, one guided by the company’s established strategies and enterprising spirit.

Prior to the announcement, Zijin’s leadership convened a two-day strategic retreat at Gutian, Fujian Province—a symbolic location in Zijin’s growth journey. Through intensive discussions and forward-looking analyses, the team reviewed 33 years of entrepreneurial experience, dissected global and industry trends, mapped the company’s strengths and weaknesses, and examined the substance underlying the position of a top global miner. The outcome was a clear framework centered on calculated growth and prudent management, culminating in the 2035 blueprint and a concrete action plan.

Once achieved, the new targets will not only reinforce Zijin’s position among the world’s leading copper and gold miners but will also establish it as one of the largest lithium and molybdenum producers globally.

To support this growth, Zijin has refined its guiding principle—adding “increasing production” to the existing approach of “improving quality, controlling costs, and boosting profitability”. The company also laid out plans for production expansion across its gold, copper, lithium, zinc and lead, silver, and molybdenum segments. These core tasks are deemed fundamental to Zijin’s focus on maximizing value creation and becoming a stronger global miner.

About Zijin Mining

Zijin Mining is a leading global metals and mining company and one of the world’s largest producers of gold, copper, and zinc. The company has more than 30 large-scale mining operations and projects across 19 countries on 5 continents. Leveraging strong in-house research, engineering, and development capabilities, Zijin maintains high operational efficiency and low costs in both acquisitions and operations. This enables the company to be an industry leader in value creation, underpinned by its philosophy of pursuing development for all and sustained by superior environmental, social, and governance performance. Zijin’s shares trade on the Hong Kong Stock Exchange (HKEX: 2899) and the Shanghai Stock Exchange (SSE: 601899).